Statistical Arbitrage applies equity long-short market neutral without human overlay and rebalanced around in 1 week to 1 month.

Typical Stat Arb

- Realized (not backtested) Sharpe Ratio > 2

- Make profit over any 6-months period

- Leverage: for \$1M capital, go \$2M long and \$2M short

- Scalable up to \$250M capacity

- Globally (developed equity markets only)

- Long-term sustainable through research

Requirement

- Managing complexity

- 10,000+ lines of code, 100’s of databases

- Must retain intellectual control at all times

- Need to “feel” the model and the markets

- Box is black to others, transparent to you

Toolkit

- Linear Algebra

- Statistics

- Economics

- Finance

- Optimization

- Programming

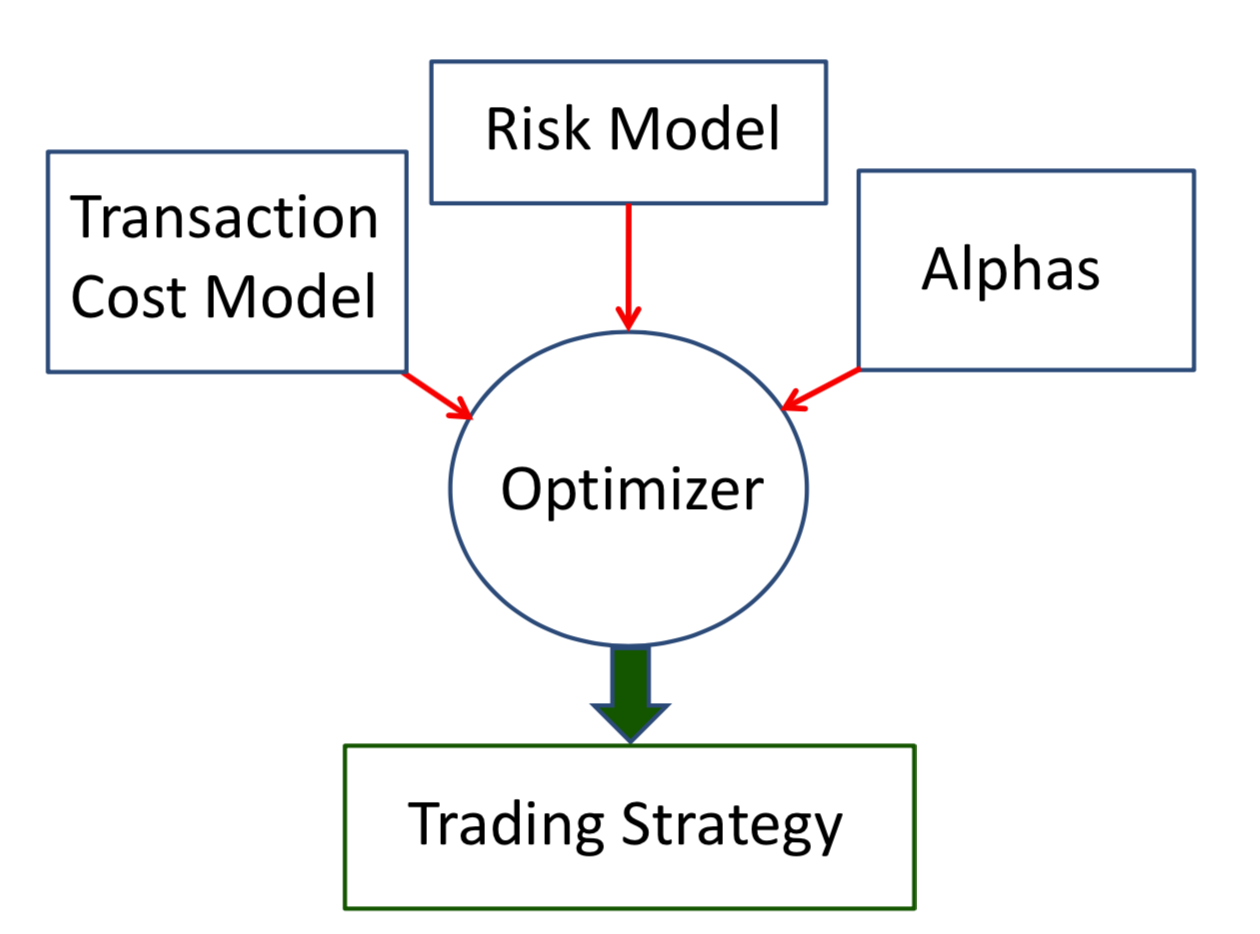

Main Component

- Alphas

- Risk Model (covariance matrix)

- T-cost model

-

Optimizer

- Overall Structure of Main Components

Alphas

\(\alpha\) is a matrix of dimension \(T \times n\)

- \(T\) = number of days in the backtest

- \(n\) = number of stocks in your universe

Sample Steps to Process Alpha

Let \(m_{t,i}\) be the relative change at day \(t\).

- Demean

- \(x_{t,i} = m_{t,i} - (m_{t,1} + \ldots + m_{t,n})/n\)

- Standardize

- \(y_{t,i} = \frac{x_{t,i}}{\sqrt{\sum_{j=1}^{n}{x_{t,j}^2}/{(n-1)}}}\)

- Windsorize

- \(\alpha_{t,i} = y_{t,i} \;\text{if} \; \mid y_{t,i} \mid \leq 3\)

- \(\alpha_{t,i} = 3 \; \text{if} \; y_{t,i} > 3\)

- \(\alpha_{t,i} = -3 \; \text{if} \; y_{t,i} < -3\)

Risk Model

T-cost Model

Maximimum Trading Size

- 1% of Average Daily Volume (ADV)

- Capped so liquid stocks do not dominate

VWAP

- Volume-Weighted Average Price

- Typically: period = 1 day

- More advanced: period = 1 hour

Simple Transaction Cost Model

\(\text{commission} + 1\text{bp} + \text{median bid-ask spread}/2\)

Market Impact Model

\(I / \sigma = \text{constant} \cdot sign(X) \cdot \mid X/VT\mid ^\beta + \text{noise}\)

- \(I=\) temporary price impact

- \(\sigma=\) daily volatility

- \(X =\) trade size

- \(V =\) average daily volume

- \(T =\) trade duration (in days)

Permanent Price Impact

\(I / \sigma = \text{constant} \cdot (X/V) \cdot (\Theta/V) ^\delta + \text{noise}\)

- \(I=\) permanent price impact

- \(\Theta=\) shares outstanding

- \(X =\) trade size

- \(V =\) average daily volume

Optimizer

Notations

| Parameter | Dimension | Definition | |:-:|:-:|:-:| | \(x\) | \(n \times 1\) | vector of desired portfolio weights | | \(w\) | \(n \times 1\) | vector of initial portfolio weights | | \(\Sigma\) | \(n \times 1\) | covariance matrix of stock returns | | \(\alpha\) | \(n \times 1\) | vector of aggregate alphas | | \(\beta\) | \(n \times 1\) | vector of historical betas | | \(\tau\) | \(n \times 1\) | vector of transaction costs |

Objectives & Constraints

- Minimize risk: \(x’ \Sigma x\)

- Maximize exposure to alpha: \(\alpha’ x\)

- Neutralize exposure to beta: \(\beta’ x = 0\)

- Minimize transaction costs: \(\tau’ \lvert x-w \rvert\)

Objective Function

\(max_{x} \underbrace{\alpha' x}_{\text{maximize alpha exposure}} - \overbrace{\lambda}^{\text{controls turnover}}\cdot \underbrace{\tau' \lvert x-w \rvert}_{\text{minimize transaction cost}} - \overbrace{\mu}^{\text{controls book size}}\cdot \underbrace{x' \Sigma x}_{\text{minimize portfolio variance}}\)

\[\text{s.t}\; \beta' x = 0\]